Invoice Management Process: A Guide That Actually Works

Learn how to optimize your invoice. This expert guide covers automation, approval workflows, common challenges, and how to reduce costs by up to 80%.

by Gustavo Ferreyra • 6/25/2025

Invoice Management Process: A Simple Guide That Actually Works

Did you know that 82% of businesses fail due to poor cash flow management? Much of this chaos comes from ineffective invoice management. Many organizations struggle to optimize their invoice management process, which is crucial for business operations. Implementing a robust invoice management system can be a game-changer for companies looking to streamline their financial processes and embrace digital transformation.

Businesses that manage invoices well can track cash flow better, build stronger supplier relationships, and make their finance departments more efficient. The entire invoice payment process from receiving invoices to making payments can improve operational performance dramatically when done right. About 58% of organizations using automation can handle the same or higher invoice volumes without hiring more staff, showcasing the power of digital invoice management solutions.

This piece covers everything in the vendor invoice management process. You’ll learn about common team challenges and how modern invoice management systems can improve this vital business function. The following sections will help you streamline your approach and achieve better financial results, whether you want to improve your current procedures or start fresh with invoice best practices.

What is invoice management and why it matters

Invoice management is the life-blood of any organization’s financial operations. This internal business function takes care of processing invoice documents from vendors and suppliers throughout their lifecycle—from receipt to payment to archiving. An effective invoice management system is crucial for maintaining accurate financial records and optimizing cash flow.

The invoice management process has five crucial stages: receiving the invoice, extracting information, proving data right, approving payments, and archiving for future reference. These steps will give a business accurate and efficient financial transactions that comply with regulations. Modern invoice management software often incorporates artificial intelligence to enhance accuracy and efficiency throughout these stages.

A look at effective invoice management’s effect on business operations reveals some striking facts. Manual invoice processing takes up over 30% of the AP team’s costs [1]. On top of that, research shows 32% of businesses believe automation could save these costs. This highlights the potential for significant time savings and cost reduction through the implementation of invoice management solutions.

Proper invoice management disrupts several business areas:

- Financial accuracy and control – Records transactions correctly, reduces financial statement discrepancies and maintains compliance with accounting standards

- Cost reduction – Makes processes lean to cut administrative costs, prevents late payment fees, and helps capture early payment discounts

- Operational efficiency – Cuts the typical five-day monthly invoice processing time [2], so the team can focus on strategic tasks instead of paperwork

- Vendor management – Creates trust through on-time, accurate payments that lead to stronger partnerships and better negotiation positions

Proper invoice management shows the company’s financial situation in real-time. This helps manage cash flow and make informed decisions. The big picture prevents cash flow problems that lead to business failure—82% of businesses fail because they manage cash flow poorly [3].

Companies that haven’t streamlined their invoice management still use manual processes. This leads to poor visibility of liabilities, more errors, and higher fraud risks. Companies that exploit invoice management systems can focus on strategic work like contract negotiation, early payment discounts, and building stronger supplier relationships. These systems often integrate with existing accounting software, creating a unified platform for financial data management.

The benefits go beyond immediate financial gains. Good invoice management helps companies follow different international regulations. This matters most to global businesses. Accurate records and audit trails make compliance and financial reporting easier. Additionally, many invoice management tools now incorporate sustainability features, helping businesses track and reduce their environmental impact.

Invoice management surpasses basic administrative tasks. It supports a company’s financial health and operational efficiency. Quick, efficient processes with clear visibility help accounts payable teams make strategic decisions about financial planning and resource allocation throughout the organization. By leveraging key performance indicators (KPIs) provided by invoice management software, businesses can continuously improve their financial processes.

The complete invoice management process explained

Image Source: stakeholdermap.com

The invoice management process forms the foundation of accounts payable operations. It creates a systematic framework to handle vendor bills from start to finish. A clear understanding of each step helps companies spot bottlenecks and areas they can improve. Let’s get into the five main stages that make up a complete invoice management workflow.

1. Invoice receipt and capture

The invoice’s trip starts when a business gets a payment request from a supplier. Invoices come through several channels:

- Physical mail requiring scanning

- Email attachments (PDF or other formats)

- Facsimile (Fax) transmissions

- Supplier portals or electronic data interchange (EDI)

The original step needs centralized invoice receipt to ensure consistent processing. Small businesses often rely on their staff to handle incoming invoices manually. Companies dealing with high volumes are now using digital capture systems more. Companies should set up a standard system to process all invoices whatever their format. This prevents scattered workflows that cause errors and confusion. Many invoice management tools now offer invoice scanning capabilities to streamline this process.

2. Data extraction and validation

The next step requires extracting and verifying invoice data. This means capturing essential information like invoice number, date, vendor details, line items, and payment terms. Manual data entry takes time and often leads to mistakes.

New invoice management systems use Optical Character Recognition (OCR) technology to pull data from digital or scanned invoices automatically. The scan quality and preprocessing techniques determine how accurate this process is. The validation happens through:

- Verification of mathematical accuracy (totals, taxes, fees)

- Two-way matching (comparing invoice to purchase order)

- Three-way matching (comparing invoice, purchase order, and goods receipt)

This verification step stops duplicate payments, fraud, and errors before invoices move to approval. Advanced invoice management software often incorporates artificial intelligence to enhance the accuracy of data extraction and validation.

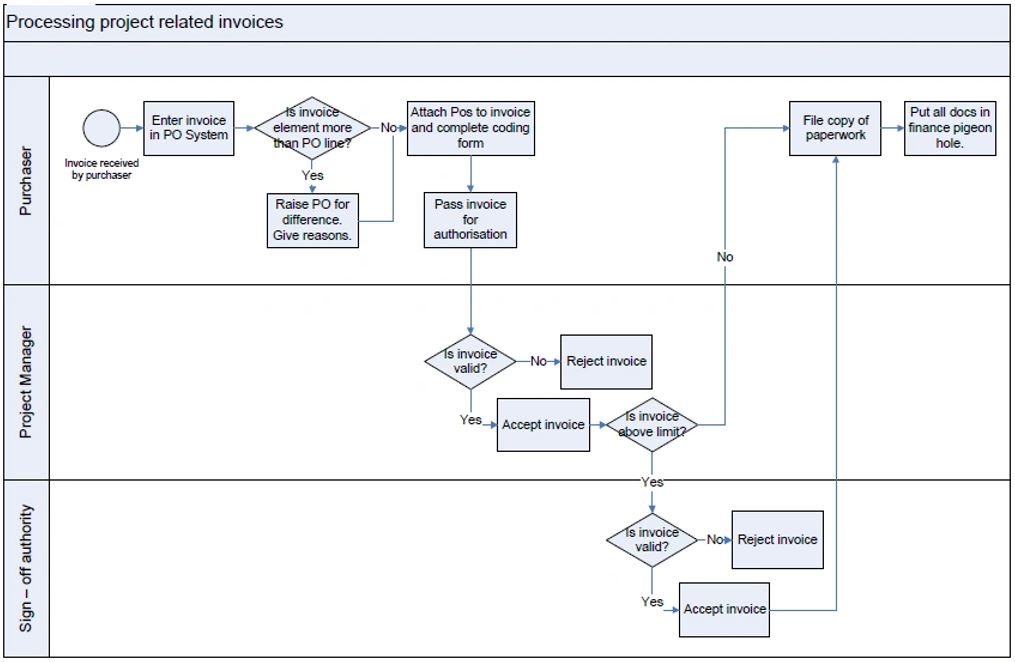

3. Approval workflows

Verified invoices then move to approval, where authorized people review and approve payment. The approval workflow changes based on company size, invoice type, and internal policies.

Manual approval needs notification by email, phone, or physical contact. This takes time and needs lots of follow-up. Many companies now use automated workflows that:

- Route invoices to right approvers based on set rules

- Send automatic notifications and reminders

- Enable mobile approvals for remote staff

- Apply approval limits that need extra authorization for larger amounts

Electronic approval processes work best for speed and tracking. Modern invoice management solutions often include customizable workflow automation features to streamline this process.

4. Payment execution

Invoices move to payment execution after getting all approvals. This stage decides when and how much to pay before starting the transaction. Payment methods include:

- Paper checks

- ACH transfers

- Wire transfers

- Global ACH transfers (local bank transfers)

- E-wallet or debit card transfers

- Virtual cards

Payment execution needs to know the vendor’s priorities and banking details. Companies handling international payments must think over currency exchange and country-specific rules. Many invoice management systems now offer integrated payment processing features to streamline vendor payments.

5. Recordkeeping and audit readiness

The last phase requires proper documentation of all transaction details. Complete documentation creates the foundation for audit readiness and smooth operations year-round.

Good recordkeeping has:

- Transactions recorded in the general ledger

- Original invoices and supporting documents stored safely

- Clear audit trails of all approvals and payments

- Simple systems to find records quickly

Good invoice recordkeeping helps companies meet regulations and makes financial reporting easier. Companies should create clear filing systems with consistent naming to find specific invoices fast. Many invoice management tools now offer secure document storage and retrieval features to support this process.

Each stage of invoice management offers chances to optimize through automation. This helps companies cut processing costs while making their operations more accurate and efficient. By implementing a comprehensive invoice management system, businesses can achieve significant time savings and improve overall financial control.

Common challenges in managing invoices

Organizations face the most important obstacles that affect efficiency and accuracy, even with well-designed invoice management processes. These challenges need solutions, and understanding them comes first.

Manual errors and data entry issues

Manual data entry creates the biggest problems in invoice processing. Research shows that businesses have a 1-2% error rate on manually processed invoices [4]. This percentage might look small at first, but companies that process thousands of invoices each month see these errors pile up faster.

AP employees can only process five manual invoices per hour [5]. This makes the approach inefficient and prone to mistakes. These errors show up as wrong amounts, vendor information mistakes, or misapplied credits. Finance teams waste valuable time fixing these issues instead of handling strategic tasks. Implementing an invoice management system with OCR and AI capabilities can significantly reduce these errors and improve data accuracy.

Delayed approvals and bottlenecks

Invoice management suffers when approvals get delayed. The Invoice Approval Workflow program needs more than two hours to handle just two thousand invoices [6]. This creates huge backlogs that lead to:

- Late payments leading to supplier frustration

- Missed early payment discounts

- Strained vendor relationships

- Distorted short-term financial outlook

Unclear approval workflows cause these bottlenecks, especially in larger organizations with complex hierarchies. Invoices can sit untouched in inboxes or on desks for long periods without defined processes or automated notifications [7]. An effective invoice management tool can streamline these approval processes through workflow automation and real-time tracking.

Fraud risks and compliance concerns

Invoice fraud threatens businesses of all sizes. Middle-market companies lose USD 280,000 on average each year to invoice fraud [8]. B2B fraud attacks increased for 37% of companies compared to the previous year [8].

Compliance challenges go beyond preventing fraud. Finance teams must handle different tax regulations across regions, keep proper documentation for audits, and ensure accurate tax reporting. Companies face expensive penalties, damage to their reputation, and financial losses when they don’t comply. Modern invoice management solutions often include built-in compliance checks and fraud detection features to mitigate these risks.

Lack of visibility and reporting

Tracking invoice status becomes error-prone without centralized systems or organized data. This visibility gap creates several issues:

- 71% of companies list manual data entry and inefficient AP processes as top pain points [9]

- AP teams waste time chasing approvals and answering status questions

- Poor cash flow planning due to limited insight into pending payments

- Difficulty generating reports for audits and compliance checks

Finance leaders don’t deal very well with tracking outgoing cash flow or identifying risks without immediate visibility into invoice status [10]. This lack of transparency hurts strategic financial planning and creates unnecessary operational challenges. Implementing a comprehensive invoice management system with real-time tracking and reporting capabilities can address these visibility issues.

Organizations can turn their invoice management systems from frustrating problems into strategic assets by fixing these common issues through process improvements and automation. This leads to better financial outcomes and supports overall digital transformation efforts within the company.

How automation improves the invoice management process

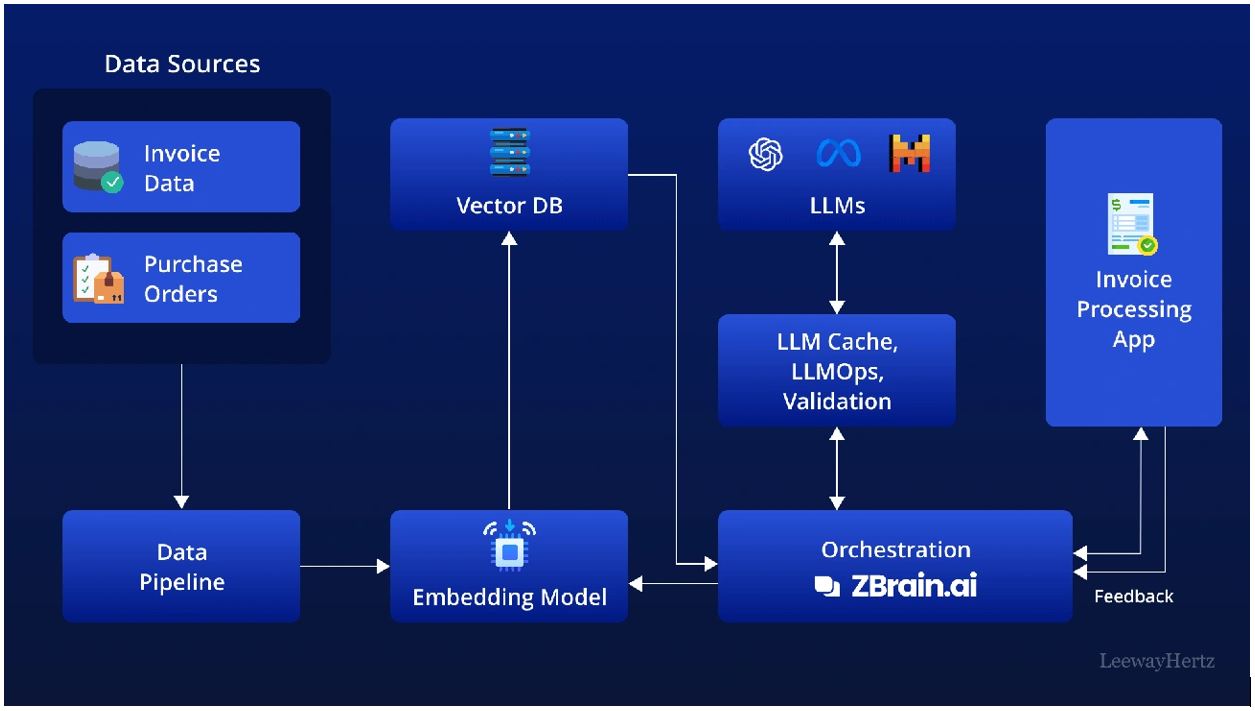

Image Source: LeewayHertz

Technology has changed how businesses manage their finances, especially their invoices. Modern automation tools tackle common invoice management challenges and make the process faster, more accurate, and transparent. Let’s explore how invoice management software and solutions are revolutionizing this critical business function.

Automated data capture and OCR

OCR technology has reshaped invoice processing by pulling data automatically from paper and digital invoices. AI and machine learning power advanced OCR systems to capture important information whatever the format or layout. Companies no longer need manual data entry, which cuts processing time by a lot and reduces human errors.

These smart systems can:

- Pull key data from invoices in different formats (PDF, images, emails)

- Get better at spotting patterns over time

- Confirm extracted information against set rules

OCR technology grows with your business and handles more invoices without needing extra staff [11]. This scalability is a key feature of modern invoice management solutions.

Smart approval routing

Automated approval workflows make invoice processing better by sending documents to the right approvers based on set rules. Research shows these systems can speed up invoice processing by 82% [12]. This leads to faster payments and happier vendors.

Smart routing systems help you:

- Spot cost centers and requestors automatically [13]

- Set up approval paths based on invoice amount, vendor, and department [13]

- Handle complex scenarios with multiple approvers [13]

This smart approach removes delays that often happen with manual processes and keeps supplier relationships strong [14]. Many invoice management tools now offer customizable workflow automation features to support these smart routing capabilities.

Integration with accounting software

Continuous connection between invoice systems and financial software creates a smooth workflow. Your invoice data moves automatically to ERP systems like SAP, Oracle, NetSuite, and Microsoft Dynamics [15].

Good integration lets businesses:

- Stop entering the same data twice

- Keep information consistent across financial systems

- Simplify accounts payable from start to finish

The system adjusts invoices automatically when sales terms change, like seasonal discounts [16], which makes financial management more flexible. This seamless integration is a key feature of modern invoice management solutions, supporting overall digital transformation efforts.

Real-time dashboards and analytics

Modern invoice systems do more than just process efficiently - they give you valuable insights through data visuals. Live dashboards work like a “command center view” of AP performance [17]. Finance teams can spot problems quickly and make informed decisions.

These analytics tools offer:

- Invoice data shown in different ways [17]

- KPIs that track things like pending approvals and processing time [17]

- Custom reports you can dig deeper into [17]

Clear visibility helps organizations control their invoice processes better. They can handle financial issues before they become problems rather than fixing them after. Many invoice management systems now include advanced analytics and reporting features to support data-driven decision-making.

Key benefits of using invoice management systems

Invoice management systems will give a company benefits that go way beyond simple automation. Companies that use these solutions see remarkable improvements in multiple areas of their business. These improvements create lasting value through better operations.

Faster processing and reduced costs

Automated invoice processing cuts processing time by up to 80% [18]. This huge improvement leads to direct cost savings. The average processing cost drops from $15-25 per invoice with manual methods to about $2 with automation [19]. These savings add up quickly for organizations that handle large volumes:

- Companies waste an average of $16 per invoice on manual processing [19]

- AP departments with end-to-end automation process more than twice as many invoices per full-time employee (18,649 vs. 8,689) [20]

- Some businesses report 75-80% reductions in processing time [21]

These significant time savings allow finance teams to focus on more strategic tasks, supporting overall business growth and efficiency.

Improved cash flow and forecasting

Cost savings are just the start. Invoice management systems give you a clear view of your financial operations. You can plan your payments better [1] with up-to-the-minute tracking of pending and approved invoices. This prevents overspending and helps optimize working capital. The system enables accurate cash flow forecasting, so businesses can make smart financial decisions based on reliable data instead of guesswork [22].

Stronger vendor relationships

Automated systems build better supplier partnerships through reliable, on-time payments. Companies that use these systems deal with fewer payment escalations [1] and have happier vendors. Supplier portals let vendors see their payment status clearly [18]. Automated reminders help ensure prompt payments and steady cash flow [23]. These improvements build trust and could lead to better terms and discounts [23]. Effective vendor management is a key outcome of implementing a comprehensive invoice management solution.

Better audit readiness and compliance

Invoice management systems create complete audit trails that track every step of the process. This detailed documentation keeps you ready for audits [1], helps meet regulatory requirements [1], and lowers the risk of penalties or financial misreporting. The system timestamps and tracks user actions, so businesses can easily show proper controls during audits [24]. Companies under regulatory scrutiny face less disruption [25] and have quick access to organized, accurate records [26]. This improved audit readiness and compliance support is a significant benefit of modern invoice management tools.

Conclusion

Invoice management is the life-blood of business success, not just another administrative task. Companies that become skilled at this vital process gain advantages in multiple operational areas. Smart invoice workflow optimization brings both immediate and lasting benefits to the entire financial ecosystem.

The five-stage invoice management process creates a well-laid-out framework that supports financial accuracy and efficiency. These stages include receipt, data extraction, approval, payment execution, and recordkeeping. Companies that use this systematic approach see major improvements in their accounts payable operations. Automation turns these processes from bottlenecks into assets that add business value.

Many organizations face common challenges like manual errors, approval delays, fraud risks, and poor visibility despite its importance. These problems waste resources and create unnecessary financial risks. Process improvements and new technology solutions are needed to support sustainable growth and digital transformation efforts.

Automated invoice management systems provide powerful solutions to these challenges. OCR technology removes manual data entry tasks. Smart approval routing speeds up processing times by up to 82%. Accounting software integration maintains data consistency. Real-time dashboards give clear visibility into financial operations. These capabilities boost efficiency and cut costs.

The advantages go way beyond the reach and influence of just saving money. Processing costs drop from $15-25 to about $2 per invoice. Better cash flow forecasting leads to smarter financial decisions based on solid data. Vendor relationships grow stronger through reliable, on-time payments. Better audit preparation reduces compliance and regulatory risks.

Companies should treat invoice management as a strategic function that deserves proper resources and attention. Organizations that adopt this point of view set themselves up for better financial control, operational excellence, and competitive edge. Modern invoice management has evolved from a basic administrative task into a powerful driver of business success. This proves that the biggest improvements often come from fine-tuning fundamental processes.

By implementing a comprehensive invoice management tool, businesses can streamline their invoice payment process, improve financial data accuracy, and support overall digital transformation efforts. These solutions offer scalability to grow with your business, accessibility for remote work environments, and the ability to track invoices in real-time. As companies continue to prioritize sustainability and risk management, invoice management systems will play a crucial role in achieving these goals through improved efficiency and data-driven decision-making.

FAQs

Q1. What is invoice management and why is it important for businesses? Invoice management is the process of handling vendor invoices from receipt to payment and archiving. It’s crucial for businesses as it ensures financial accuracy, reduces costs, improves operational efficiency, and strengthens vendor relationships. Effective invoice management also provides real-time visibility into a company’s financial landscape, enabling better cash flow management and informed decision-making.

Q2. How can automation improve the invoice management process? Automation significantly enhances invoice management by implementing technologies like OCR for data capture, smart approval routing, integration with accounting software, and real-time dashboards. These tools reduce manual errors, speed up processing times, provide better visibility into financial operations, and enable more strategic decision-making.

Q3. What are the common challenges in managing invoices? Common challenges in invoice management include manual errors in data entry, delayed approvals causing bottlenecks, increased fraud risks and compliance concerns, and lack of visibility in reporting. These issues can lead to inefficiencies, financial losses, and strained vendor relationships if not addressed properly.

Q4. What are the key stages in the invoice management process? The invoice management process typically involves five critical stages: 1) Invoice receipt and capture, 2) Data extraction and validation, 3) Approval workflows, 4) Payment execution, and 5) Recordkeeping and audit readiness. Each stage plays a crucial role in ensuring accurate and efficient processing of invoices.

Q5. What benefits can businesses expect from using an invoice management system? Businesses using invoice management systems can expect faster processing times and reduced costs, with some companies reporting up to 80% reduction in processing time. Other benefits include improved cash flow forecasting, stronger vendor relationships due to timely payments, and better audit readiness and compliance. These systems also provide valuable insights through data analytics, enabling more informed financial decision-making.

References

- Spendflo — Invoice Management Guide: Cash Flow Optimization

- DocuClipper — Invoice Management

- ZipHQ — What Is Invoice Management?

- Stampli — Invoice Processing Errors

- MineralTree — Common Invoice Management Challenges

- Oracle E-Business Suite — Knowledge Base 2921883_1

- Dokka — Common Problems with Invoice Processing

- Basware — Combat Invoice Fraud

- Applexus — Compliances in Invoice Processing

- Procurify — Invoice Workflow

- HighRadius — Invoice Capture

- Tipalti — OCR Invoice Processing

- AppZen — Smart Invoice Approval Workflows

- Corcentric — Smart Approval Routing

- Medius — Invoice Capture

- NetSuite — Integrated Accounting System

- Stampli — Dashboards

- Tipalti — Automated Invoice Processing

- Tax1099 — How Invoice Automation Improves Accuracy

- Concur — Reduce Invoice Processing Costs

- Ramp — Best Invoice Management Software

- Brex — Automated Invoice Processing

- GGAdvisors — Streamlining Invoice Processing

- CloudXDPO — Improve Audit Readiness

- Medius — AP Automation and Compliance

- TurboDoc — Compliance and Audits with Automation