Why Your Invoice Approval Workflow Is Costing You Money – 2025 Guide

Find out how a slow invoice approval workflow drains your budget and learn proven automation fixes in this 2025 guide.

by Gustavo Ferreyra • 6/24/2025

Why Your Invoice Approval Workflow Is Costing You Money [2025 Guide]

Manual invoice approvals and accounts payable processes cost businesses $12 per invoice on average. This cost grows substantially as companies expand and handle more invoices. The seemingly small amount builds up fast and creates a major financial burden that many organizations overlook.

The traditional invoice approval process creates several inefficiencies beyond direct costs. Small companies take 15 days to pay invoices. Enterprise businesses need up to 20 days to complete the same task. These delays happen because of poorly managed invoice processing workflows. Teams waste time looking for documents and following up on approvals. Remote work makes invoice automation workflow even more important. Bottlenecks occur when approvers work offsite.

This piece explains why inefficient invoice approval systems drain company resources. We’ll show how the right invoice approval software can improve this core business function. You’ll learn about the hidden costs of manual processes and common bottlenecks. We’ll also give you practical strategies to optimize your invoice management system and accounts payable workflow.

What is an invoice approval workflow and why it matters

An invoice approval workflow is a step-by-step process organizations use to check, authorize and process supplier invoices before payment. This is a vital control mechanism in the accounts payable department that makes sure all invoices are legitimate, accurate, and properly authorized [1].

Definition and purpose

The invoice approval process acts as a financial safeguard to confirm incoming invoices match expected costs and received goods or services. The process starts when an invoice arrives and moves through verification, matching, approval routing, and payment processing [2].

This process does more than just pay bills. A well-laid-out invoice flow:

- Keeps financial operations transparent and accountable

- Stops duplicate payments and invoice fraud

- Makes sure internal policies are followed

- Helps maintain good vendor relationships through timely payments

- Creates complete audit trails for financial control [3]

Who is involved in the process

The invoice approval process needs teamwork from many people in the organization. The accounts payable team coordinates everything, while other departments play vital roles too.

AP staff check invoice authenticity and look for discrepancies when they receive them [3]. They make sure all needed information matches supporting documents. Department managers or people who made the purchases then review invoices to check if the goods or services were received correctly [2].

High-value invoices often need multiple approvals. Finance executives like CFOs or controllers usually give final approval, especially for invoices above certain amounts [4]. Legal teams might need to review invoices related to contracts or compliance issues [5].

A newer study published in 2023 shows that 49% of AP teams think the invoice/payment approval takes too long, which shows how complex it is to coordinate everyone involved [1].

Where things typically go wrong

The invoice approval workflow has many challenges, especially with manual processes. The biggest problem is getting approvals—it’s hard to reach approvers quickly, which leads to late payments and unhappy vendors [1].

Invoice approval bottlenecks happen because of:

- Remote work complications: Manual processes that need physical paperwork don’t work well when people work remotely [6].

- Lost documentation: Without a central system, invoices and documents get lost, making them hard to track [2].

- Approval delays: People miss email requests and need multiple follow-ups [2].

- Error susceptibility: Manual data entry causes mistakes like duplicate payments [6].

- Fraud vulnerability: Paper systems don’t have strong verification methods to prevent fraud [7].

These problems get worse in bigger organizations with complex hierarchies and multiple departments. Without clear processes or automated notifications, invoices sit untouched. Companies miss early payment discounts and damage their vendor relationships [8].

Organizations that use invoice automation workflow can fix these issues with automated approval routing, notifications, and better invoice tracking throughout the process.

The hidden costs of a manual invoice approval process

Manual invoice approval workflows hide expenses that quietly eat away at company profits. These costs go way beyond the reach and influence of visible expenses like paper and ink. They affect an organization’s efficiency and financial health in ways many businesses don’t realize.

Time lost in document chasing

Manual invoice processing eats up valuable staff hours. Companies with traditional approval processes see their employees spend about 20% of their work hours handling invoices [9]. This costs roughly $10,000 per employee each year just to manage invoices [10].

A single invoice takes 14.6 days to process manually [11]. Finance teams waste up to 16 days yearly just fixing invoice errors [10]. The problem gets worse when you look at these facts:

- All but one of these businesses spend over five days monthly on invoices [11]

- Each invoice validation request needs about one hour [9]

- Processing an invoice manually costs between $12.88 and $30.00 [12]

A mid-sized company that processes 3,000 invoices yearly could waste more than $36,000 just on time costs [9].

Duplicate payments and human errors

Data entry by hand leads to expensive mistakes. Research shows that staff catch only 39% of invoice errors during regular checks [3]. Money leaks throughout the process. These errors need extensive fixes that increase processing costs by up to 20% per invoice [3].

Error rates in manual systems hit about 1.6% per invoice [10]. Each mistake costs around $53 to fix [10]. About one-third of businesses deal with duplicate payments [11]. This happens when vendors send multiple copies or when different team members process the same invoice [7].

Missed early payment discounts

Companies miss cost-saving chances because traditional invoice processing takes too long. The average processing cycle runs 13.5 days [13]. Yes, it is true that businesses lose up to $3 per invoice in missed early payment discounts [14].

Larger mid-sized companies lose about $4.5 million monthly from these missed opportunities [15]. The slow processing also results in roughly $909,506 in delayed payments monthly for mid-sized companies [15].

Vendor dissatisfaction and strained relationships

Late payments hurt supplier relationships badly. The UK’s five largest retailers take 61 days or more to pay 25% of their invoices [16]. This creates problems with vendors and limits future bargaining power.

Invoice errors start disputes that hurt these relationships more. About 82% of companies lose revenue because of invoicing conflicts [15]. 85% of businesses don’t get paid the full amount due to these disputes [15].

Suppliers have to keep asking about their invoice status when payments are late. This creates extra work for AP departments. 91% of CFOs say they have to ask customers repeatedly for more details during disputes. 59% need to do this almost every time [15]. This constant back-and-forth wastes resources and damages business relationships.

Invoice workflow automation fixes these hidden costs. It speeds up processing, cuts down errors, helps catch early payment discounts, and builds better vendor relationships through on-time, accurate payments.

Common bottlenecks in traditional invoice processing workflows

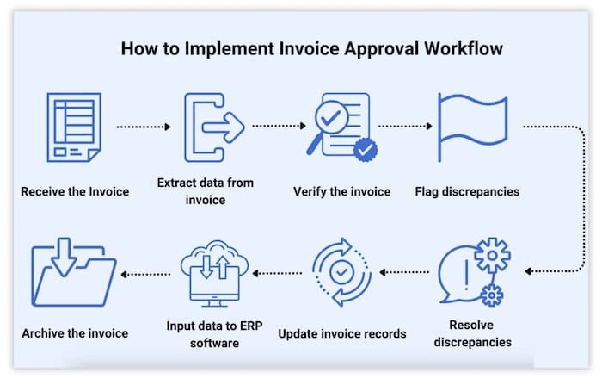

Image Source: Small Business HQ

Traditional invoice processing workflows often break down and create operational gridlock that costs businesses time and money. Companies with years-old systems still face recurring bottlenecks that hurt their efficiency and financial control.

Lack of visibility and tracking

Finance teams can’t identify where invoices are in the approval pipeline without centralized systems. This creates confusion and slows down decision-making [6]. The problem affects the whole organization since generating reports for audits or compliance checks takes too much time when information is scattered between emails, spreadsheets, and filing cabinets [7].

A Stampli survey shows finance leaders’ biggest accounts payable headaches are slow approvals (18%), too much paper (15%), and manual processes (15%) [5]. Vendors have to follow up repeatedly because teams don’t deal very well with payment status monitoring or quick dispute resolution, which adds more work for AP departments [7].

Slow approval cycles

AP leaders point to slow invoice approval cycles as one of their toughest challenges, according to Ardent Partners [17]. Several factors cause these delays:

The process slows down when teams need to find the right approver, forward invoices, and get sign-offs [5]. Invoices sometimes go to the wrong approvers, or the right people are unavailable or forget about pending invoices [5]. Each extra approval level makes things even more complicated [17].

Disorganized document management

Paper documents create major inefficiencies throughout the invoice lifecycle. Teams waste time on manual tasks like:

- Printing, reading, and filing paper invoices

- Looking for misplaced or wrongly filed documents

- Scanning documents multiple times during approval routing

- Finding storage space for paper archives [18]

Staff members spend too much time filing and retrieving paper invoices, searching for lost documents, and fixing mistakes [18]. More than half of organizations spend over ten hours each week processing invoices and supplier payments [1].

Remote work challenges

The move to remote work showed major flaws in traditional invoice approval systems. Paper-based processes become a real problem when approvers or AP staff work from home [2]. Invoices pile up in empty offices, left untouched and unprocessed [8].

Some companies try to solve this by having AP staff visit offices in rotation to collect paper invoices. This puts employee health at risk and still isn’t efficient [8]. During COVID-19, Sidetrade reported a huge jump in late payments - average unpaid invoices (10+ days past due) went from 15.5% to 31.9% [8].

Remote work makes it harder to access needed resources and documents. Teams also face security risks when they share information through channels that aren’t properly secured [19].

How invoice approval automation reduces costs and errors

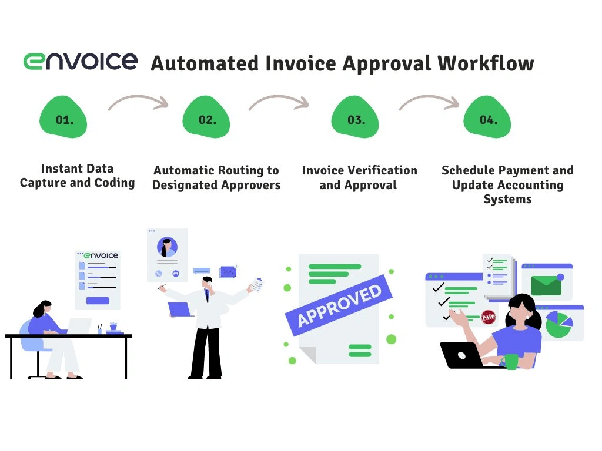

Image Source: Envoice

Invoice workflow automation revolutionizes financial operations by cutting costs and preventing errors. Companies that use end-to-end automation can reduce their invoice processing costs from USD 15-25 to just USD 2 per invoice [20]. This represents an 80% reduction in processing expenses.

Faster invoice validation and routing

Automation speeds up invoice processing by removing manual data entry and optimizing approvals. Manual processing takes about 12 minutes per invoice, while automated systems need only 2 minutes [21]. Digital capture tools extract invoice data as soon as it arrives. Smart workflows then route documents to the right approvers based on preset rules, which eliminates manual routing time.

AP departments using automation process 18,649 invoices per full-time employee each year, compared to 8,689 without it [22]. Estimate Software and Invoice Generation Here to learn how automation can streamline your business processes.

Automated 3-way matching

A key breakthrough in invoice approval automation is automated three-way matching. This system checks if purchase orders, receiving documents, and invoices all line up. The process:

- Matches invoice lines with their purchase order counterparts

- Checks unit prices and quantities against preset limits

- Auto-approves matched invoices and flags any differences

Three-way matching cuts invoice approval times from 40 to 10 days [4]. It also stops fraud by catching unauthorized or duplicate transactions that cost companies about 5% of yearly revenue [23].

Real-time status updates and audit trails

Modern invoice approval systems show exactly where invoices are in the process. Unlike manual systems where invoices get lost in approval bottlenecks, automation tracks everything live by status like “in-process,” “approved,” or “under review” [24].

This clear view helps AP departments manage cash and spending better [22]. Companies can take advantage of early payment discounts more often [21].

Improved compliance and fraud prevention

Automation cuts accounts payable fraud by up to 75% [25]. These systems keep companies compliant with financial policies and regulations through consistent approval rules and automated workflows.

The system’s audit trails record every step in the invoice process. This creates solid evidence for auditors and protects against unauthorized actions [26].

Best practices to optimize your invoice approval system

Your invoice approval system needs proven approaches to boost efficiency and reduce errors. Organizations can turn their invoice processing from a liability into a competitive edge by adopting these best practices.

Set up multi-tier approval rules

Clear approval hierarchies make sure invoices reach the right decision-makers based on specific criteria. Value-based routing sends invoices to designated approvers based on total amount, and higher-value invoices need executive approval [27]. The workflow efficiency improves when you use criteria-based routing that automatically directs invoices based on department, cost center, or business unit [28]. These rules should adapt to organizational changes while maintaining control.

Use OCR and AI for data capture

AI-powered Optical Character Recognition (OCR) technology revolutionizes invoice processing by extracting critical data from paper and digital documents automatically. Modern OCR systems read different invoice formats with minimal human input [29]. The system captures essential details like invoice numbers, PO numbers, line items, and amounts [28]. Machine learning helps these systems become more accurate with each processed invoice [30]. Companies using OCR technology have reduced their processing times by a lot - from 12 minutes per invoice with manual processing to just 2 minutes with automation [30].

Integrate with your ERP or accounting software

A smooth connection between your invoice approval software and existing financial tools creates major efficiency gains. Well-integrated systems share data automatically through APIs or flat-file transfers [31]. This eliminates manual data entry and cuts down errors [32]. The integration lets invoices pull needed data from purchase orders automatically and helps with three-way matching [27]. You should test the integration fully before implementation to spot potential issues and optimize performance [33]. Estimate Software and Invoice Generation Here helps you assess potential integration options for your specific environment.

Train teams on new workflows

The most sophisticated automation tools won’t work without proper user adoption. Detailed training helps staff use new systems effectively [34]. Teams need role-specific training that fits approvers, finance staff, and IT support [34]. Each department should have power users who help colleagues learn the system [34]. The core team needs ongoing training and support to minimize disruptions during transitions and make full use of available features [27].

Conclusion

Revolutionize Your Invoice Approval Process Today

Manual invoice approval processes drain financial resources and create unnecessary friction across your organization. Companies that use ap automation save about 80% on processing costs. Their expenses drop from $15-25 per invoice to just $2 [20]. On top of that, it cuts down processing time from 12 minutes to 2 minutes per invoice [21]. These improvements directly impact your bottom line.

Many businesses are reluctant to change their long-standing procedures. The cost of keeping manual systems is nowhere near the cost of implementing new ones. Manual errors show up in about 1.6% of invoices [10], and each mistake costs around $53 to fix [10]. Mid-sized companies lose millions each year just from missed early payment discounts [15].

Today’s competitive world just needs financial agility and precision. Your business faces several disadvantages without efficient invoice processing. Vendor relationships suffer and cash flow management becomes complicated. Automation is no longer a luxury - it’s essential to run sustainable operations.

Smart organizations must review their current invoice workflows against industry measures. Start by checking your average processing time and cost per invoice. Find the specific bottlenecks in your approval chain. Calculate how much you could save with automation based on your invoice volume.

Your invoice approval system shows your company’s operational maturity. Companies that make this process efficient gain advantages through better vendor terms, lower operational costs, and improved financial visibility. Efficient financial management starts when you become skilled at basic processes like invoice approval. This small change brings remarkable returns.

FAQs

Q1. What is an invoice approval workflow and why is it important? An invoice approval workflow is a systematic process for verifying, authorizing, and processing supplier invoices before payment. It’s crucial for maintaining financial control, preventing errors and fraud, ensuring compliance, and maintaining good vendor relationships.

Q2. How can automating the invoice approval process reduce costs? Automation can reduce invoice processing costs by up to 80%, from $15-25 per invoice to about $2. It speeds up processing time from 12 to 2 minutes per invoice, reduces errors, captures early payment discounts, and improves cash flow management.

Q3. What are common bottlenecks in traditional invoice processing? Common bottlenecks include lack of visibility in tracking invoices, slow approval cycles, disorganized document management, and challenges with remote work. These issues can lead to delayed payments, missed discounts, and strained vendor relationships.

Q4. How does automated three-way matching improve invoice processing? Automated three-way matching verifies consistency across purchase orders, receiving documents, and invoices. It can reduce approval timelines from 40 to 10 days, prevent fraud by identifying unauthorized transactions, and significantly reduce errors in the invoice process.

Q5. What are some best practices for optimizing an invoice approval system? Key best practices include setting up multi-tier approval rules, using OCR and AI for data capture, integrating with existing ERP or accounting software, and providing comprehensive training for staff on new workflows. These strategies can dramatically improve efficiency and accuracy in invoice processing.

References

[1] - https://www.revolutiondatasystems.com/blog/3-solutions-to-common-invoice-processing-problems

[2] - https://www.mineraltree.com/blog/invoice-approval-workflow/

[3] - https://resolvepay.com/blog/17-statistics-showing-the-hidden-cost-of-invoice-errors-and-rework

[4] - https://www.zycus.com/blog/accounts-payable/automated-3-way-matching-is-key-to-accounts-payable-success

[5] - https://www.stampli.com/blog/accounts-payable/handling-slow-internal-invoice-approvals/

[6] - https://www.dataserv.com/blog/high-cost-of-low-invoice-visibility/

[7] - https://dokka.com/common-problems-with-invoice-processing-and-how-to-fix-them/

[8] - https://softco.com/blog/overcoming-remote-working-challenges-for-accounts-payable/

[9] - https://blog.approvalmax.com/hidden-cost-of-manual-approvals

[10] - https://www.gocomet.com/blog/cost-impact-of-manual-vs-automated-invoice-processing/

[11] - https://caso.com/2025/03/the-hidden-costs-of-manual-accounts-payable-and-how-automation-solves-them/

[12] - https://www.bottomline.com/resources/blog/hidden-and-not-so-hidden-costs-of-manual-accounts-payable

[13] - https://meliopayments.com/blog/is-your-business-missing-out-on-early-payment-discounts/

[14] - https://ocrsolutions.com/10-common-challenges-in-invoice-processing/

[15] - https://www.versapay.com/resources/poor-invoice-processing-impact

[16] - https://the-cfo.io/2024/06/11/efficient-invoice-management/

[17] - https://edenredpay.com/accelerate-invoice-approvals-with-invoice-approval-workflow/

[18] - https://start.docuware.com/blog/document-management/document-management-for-invoice-processing-a-beginners-guide

[19] - https://www.owis.com/en/blog/remote-work-and-invoice-management

[20] - https://www.tax1099.com/payments/blog/how-invoice-automation-improves-accuracy-and-reduces-costs/

[21] - https://coreintegrator.com/invoice-processing-cost-savings-analysis/

[22] - https://www.concur.com/en-us/resource-center/whitepapers/use-automation-to-reduce-cost-of-invoice-processing

[23] - https://www.netsuite.com/portal/resource/articles/accounting/three-way-matching.shtml

[24] - https://ramp.com/blog/what-is-invoice-approval-software

[25] - https://www.tax1099.com/payments/blog/how-ap-automation-can-help-prevent-payment-fraud/

[26] - https://www.cflowapps.com/invoice-approval-system/

[27] - https://www.highradius.com/resources/Blog/invoice-approval-workflow/

[28] - https://tipalti.com/resources/learn/invoice-approval-workflow/

[29] - https://learn.microsoft.com/en-us/dynamics365/finance/accounts-payable/invoice-capture-overview

[30] - https://start.docuware.com/blog/document-management/invoice-ocr

[31] - https://www.highradius.com/resources/Blog/ap-automation-erp-integration/

[32] - https://approveit.today/blog/best-practices-for-the-efficient-approval-of-invoices

[33] - https://www.truecommerce.com/blog/e-invoicing-erp-integration-best-practices/

[34] - https://www.procurify.com/blog/invoice-approval-software/