Cost Codes: How They Drive Financial Success (Construction & IT)

A cost code is a unique identifier used in accounting and project management to categorize and track expenses.

by Quickadmin • 9/9/2024 · Updated: 10/6/2025

Cost code management is essential for any industry as it allows for precise expense tracking and better financial management. However, the structure and use of these codes can vary significantly depending on the sector. For example, in the construction industry, cost codes are often highly detailed to cover aspects such as labor, materials, and equipment. In contrast, in the information technology sector, codes may focus on software development, hardware maintenance, and data center operations. This variability ensures that each industry can tailor its cost codes to its specific needs, facilitating more efficient and transparent resource management.

What is a Cost Code?

A cost code is a unique identifier used in accounting and project management to categorize and track expenses. It helps in organizing costs related to specific tasks, projects, or departments, making it easier to manage budgets and analyze financial data.

Why Are There So Many Cost Codes?

There are many cost codes because they are designed to cover a wide range of expenses and activities. Different industries and businesses have unique needs, so cost codes can be highly specific to ensure accurate tracking and reporting. For example, in construction, you might have separate cost codes for labor, materials, equipment rental, and subcontractor fees. Here are some additional reasons why there are so many cost codes:

Detailed Financial Tracking: Cost codes allow for granular tracking of expenses, which helps in identifying where money is being spent. This level of detail is crucial for managing budgets effectively and ensuring financial accountability.

Project Complexity: Large and complex projects often involve numerous activities and resources. Cost codes help in breaking down these projects into manageable parts, making it easier to monitor and control costs at each stage.

Industry-Specific Requirements: Different industries have unique cost structures and reporting requirements. For example, in construction, you might have separate cost codes for labor, materials, equipment rental, and subcontractor fees. In IT, you might have codes for software development, hardware procurement, and operational costs.

Regulatory Compliance: Many industries are subject to regulatory requirements that mandate detailed financial reporting. Cost codes help organizations comply with these regulations by providing a clear and organized way to document expenses.

Performance Analysis: By using cost codes, organizations can analyze the financial performance of different projects, departments, or business units. This analysis can reveal insights into cost efficiency, profitability, and areas for improvement.

Budgeting and Forecasting: Cost codes are essential for creating accurate budgets and forecasts. They provide a historical record of expenses that can be used to predict future costs and allocate resources more effectively.

Internal Controls: Cost codes help in establishing internal controls by providing a systematic way to track and approve expenses. This reduces the risk of fraud and ensures that funds are used appropriately.

Resource Allocation: Detailed cost tracking enables better resource allocation. Organizations can identify which areas are consuming the most resources and make informed decisions about where to invest or cut back.

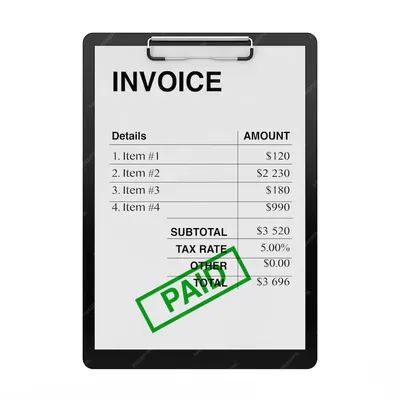

Why Do You Need to Choose One for Invoice Price Items?

Choosing the correct cost code for each item on your invoice is important for several reasons:

- Accurate Accounting: It ensures that expenses are recorded correctly, which is crucial for financial reporting and tax purposes.

- Budget Management: Helps in monitoring and controlling project budgets by tracking where money is being spent.

- Project Analysis: Facilitates detailed analysis of project costs, helping identify areas where you might be overspending or saving.

- Transparency: Provides clarity to clients and stakeholders about what they are being charged for, enhancing trust and communication.

Let’s dive into how cost codes drive financial success across different industries, from construction to IT.

Cost codes in construction

In the construction industry, cost codes are used to track expenses related to labor, materials, equipment, and overhead. Here’s how they contribute to financial success:

- Accurate Budgeting: Cost codes allow for precise budgeting by breaking down costs into specific categories. This helps in creating detailed and accurate project estimates.

- Efficient Cost Tracking: By assigning cost codes to different aspects of a project, construction managers can monitor expenses in real-time, ensuring that the project stays within budget.

- Improved Decision-Making: With detailed cost data, managers can make informed decisions about resource allocation, project timelines, and potential cost-saving measures.

- Enhanced Reporting: Cost codes facilitate detailed financial reporting, making it easier to analyze project performance and profitability.

Cost codes in IT

In the IT industry, cost codes are used to manage expenses related to software development, hardware procurement, and operational costs. Here’s how they drive financial success:

- Project Management: Cost codes help in tracking the costs associated with different phases of software development, such as design, coding, testing, and deployment.

- Resource Allocation: By categorizing expenses, IT managers can allocate resources more effectively, ensuring that funds are used efficiently.

- Cost Control: Real-time tracking of expenses helps in identifying cost overruns early, allowing for timely interventions to keep the project on track.

- Financial Analysis: Detailed cost data enables IT managers to analyze the financial performance of projects, identify areas for improvement, and plan future projects more effectively.

Managing cost codes effectively is crucial for accurate financial tracking and project management. Here are some best practices to consider:

Best practices for cost code management

1. Standardize Cost Codes

- Consistency: Use a standardized set of cost codes across all projects to ensure consistency.

- Documentation: Maintain a detailed list of all cost codes and their descriptions for easy reference.

2. Train Your Team

- Education: Ensure that all team members understand the cost coding system and its importance.

- Guidelines: Provide clear guidelines on how to apply cost codes correctly.

3. Use Software Tools

- Accounting Software: Utilize accounting or project management software that supports cost coding.

- Automation: Automate the assignment of cost codes where possible to reduce errors.

4. Regular Reviews

- Audits: Conduct regular audits to ensure cost codes are being used correctly.

- Updates: Periodically review and update cost codes to reflect any changes in project scope or business needs.

5. Detailed Reporting

- Reports: Generate detailed reports that break down costs by code to analyze spending patterns.

- Analysis: Use these reports to identify areas of overspending or potential savings.

6. Clear Communication

- Transparency: Communicate the importance of accurate cost coding to all stakeholders.

- Feedback: Encourage feedback from team members to improve the cost coding process.

7. Segregate Costs

- Categories: Segregate costs into categories such as labor, materials, equipment, and overhead.

- Subcategories: Use subcategories for more granular tracking.

8. Monitor Compliance

- Policies: Establish policies for cost code usage and monitor compliance.

- Corrective Actions: Implement corrective actions if discrepancies are found.

By following these best practices, you can ensure that your cost coding system is efficient, accurate, and beneficial for your financial management and project tracking needs.

FAQ: Cost Codes & Financial Control

What are cost codes, and how are they different from cost centers?

Cost codes are line-item labels for specific tasks, materials, or phases (e.g., 09.54 Painting—Labor). Cost centers are broader accounting buckets (e.g., “Production” or “Overhead”). Use cost codes on transactions; map them to cost centers for financial statements.

How do cost codes speed up invoice approvals?

They make scope and budget context obvious. Approvers see the code, budget, and remaining balance at a glance—cutting back-and-forth and reducing AP cycle time because fewer charges are “mystery spend.”

How do I map cost codes to QuickBooks categories?

Create a one-to-one or many-to-one mapping: each cost code points to a Chart of Accounts category (and class/location if used). Keep mapping stable, review quarterly, and document exceptions (e.g., subcontract vs materials under the same code).

Are cost codes worth it for small teams?

Yes—start with 15–30 high-impact codes (labor, materials, equipment, subs, overhead). Even light structure improves estimating accuracy, WIP tracking, and margin visibility without adding admin overhead.

How can I roll up labor, materials, and equipment by code in reports?

Tag every line with a cost code and a cost type. Your report engine can subtotal by code, then split by type—giving you unit costs, burn rate, and forecast-to-complete per activity.

How does QuickAdmin handle cost codes from estimate to invoice?

You add codes to estimate line items, then convert the estimate to an invoice with codes preserved. Invoices, bills, and POs can keep the same codes for clean job cost reports and COA mapping.

Should my structure be flat or nested?

Use nested (parent:child) when you need consistent rollups (e.g., 09 Finishes → 09.54 Painting → 09.54.10 Labor). Keep names short, enforce a naming pattern, and avoid one-off codes that dilute reporting.

How do change orders affect cost codes and budgets?

Create CO lines with the correct codes. Your budget increases only for those codes, so reports show original vs revised budget, committed, and actuals at the exact activity where scope changed.