Free Invoice Tracker

Discover the top free invoice tracker templates for 2025. Improve payment tracking, cash flow, and client relationships with easy-to-use tools for small businesses.

by Gustavo Ferreyra • 6/17/2025

Free Invoice Tracker: Why Small Businesses Are Switching to These Templates [2025 Guide]

Small businesses need free invoice tracking tools to keep their cash flow healthy and finances accurate. These tools are becoming more popular faster than ever. Payment mistakes can get pricey and waste time that affects your business operations. A well-managed invoice system is vital to keep transactions transparent and build better relationships with suppliers.

More small businesses now use invoice tracker templates instead of expensive software. You’ll find everything from simple spreadsheets to advanced online platforms. Many start with a free Excel template and move to stronger systems as their business expands. These modern templates are packed with features you’d normally pay for - like automatic payment reminders and custom reports. This piece looks at why these tools are must-haves for small businesses in 2025 and how they change financial management across companies of all sizes.

Why invoice tracking matters for small businesses

Small business owners know that keeping track of invoices isn’t just about staying organized—it’s about staying alive. Poor invoice tracking creates problems that go way beyond simple bookkeeping issues. Let’s learn about why proper invoice management has become essential to small business success.

The hidden cost of missed or late payments

The reality for small businesses is stark: 73% of businesses say late invoices hurt their operations [1]. This threat to business stability can’t be ignored.

Recent research reveals that 40% of small business owners believe their businesses might shut down within a year if late payments persist [1]. These delays create immediate cash flow problems that hurt everything from employee paychecks to business growth opportunities.

Time spent chasing payments adds another huge hidden cost. About 10% of small business owners spend 5-10 hours each week pursuing late invoices, while 20% spend 1-4 hours [1]. This adds up to 260 hours every year—that’s 12.5% of yearly working hours that could help grow the business instead.

Money owed to businesses paints an equally troubling picture. Around 28% of small businesses are owed up to £9,999 in late payments, and 14% are waiting on £10,000 to £49,999 [1]. The average amount owed could pay for a new employee’s salary.

How manual tracking guides mistakes

Manual invoice tracking opens the door to expensive errors. Research shows one in ten invoices has some kind of error, and businesses miss half of these mistakes before processing payments [2].

The Institute of Finance and Management highlights human error as an ongoing issue in manual invoice processing. A concerning 3.6% of all supplier invoices contain mistakes [2]. These errors tend to snowball over time.

Double payments often happen because of data entry mistakes, misused financial software, or forgotten unpaid invoices [3]. Suppliers sometimes send second invoices when payments are late. This creates tension between parties and more work for accounts payable teams.

Manual processes make fraud more likely. The Association of Certified Fraud Examiners reports that companies lose about 5% of revenue to fraud each year, with typical losses reaching $125,000 [3]. Manual systems don’t protect well against embezzlement, fake payments, and financial statement fraud.

Why 2025 is different: remote work and digital payments

Small business invoicing has changed completely in 2025, thanks to remote work becoming normal and digital payment options expanding.

Remote business owners face new invoicing challenges [4]. To name just one example, a small tech startup working remotely might have trouble billing clients across multiple continents with different tax rules. Manual invoice entry makes this worse by causing frequent errors and payment delays.

The electronic invoicing market shows this change, with expected growth at 22.4% yearly until 2031 [5]. This growth shows that manual invoicing can’t keep up with today’s business needs.

Digital invoicing helps small businesses by automating invoice processing and tracking important data like upcoming and outstanding invoices [6]. E-invoicing lets businesses handle late payments better by setting up automatic payment reminders for customers.

Free invoice tracker templates now include features you used to find only in paid software. From automated payment alerts that reduce overdue invoices to custom reporting tools, these templates offer more. Many companies start with a simple invoice tracker Excel template (free) before moving to more complete solutions as they grow.

Remote workers now see automation as necessary, not optional. A remote agency’s story showed this well. They made their cash flow more stable by automating invoice creation and sending timely payment reminders. This brought in steadier income and reduced money stress [4]. Budget-friendly invoice tracker templates now offer these features that once required expensive software.

What is a free invoice tracker template?

A invoice tracker template is the life-blood of financial management for businesses that need to host their billing processes without expensive software. This tool has become more popular as it helps businesses stay organized. It maintains healthy cash flow through systematic record-keeping.

Definition and purpose

A invoice tracker template is a pre-designed document that lets businesses keep detailed records of their invoices in one central location. These templates are simpler than complex accounting systems. They provide a direct way to record, monitor, and organize payments. Your financial tracking becomes smoother and more reliable by preventing lost or misplaced bills.

These trackers do more than just organize. They work as:

- Financial oversight tools that display outstanding payments and due dates instantly

- Cash flow management systems that calculate totals with taxes and fees

- Record-keeping solutions that store historical payment data to report

- Payment reminder systems that flag overdue invoices

Most templates include key fields for invoice numbers, dates, client information, amounts, and payment status. Free invoice trackers shine because they can add up outstanding invoices. They track paid versus pending payments without technical knowledge or extra costs.

Common formats: Excel, Google Sheets, PDF

Free invoice tracker templates come in different formats with unique advantages:

Excel invoice tracker templates lead the pack because they’re flexible with powerful calculation features. Excel comes with built-in formulas, filters, and formatting options that make invoice management easier. Users can highlight overdue payments in red automatically. Paid invoices turn gray for better visual tracking. Excel trackers let you sort and filter by date or customer with ease.

Google Sheets templates work just like Excel but add cloud storage and team editing. Team members can update invoice information at the same time from anywhere. This feature matters more now with remote work. Google Sheets also works well with other Google Workspace tools.

PDF templates offer less flexibility but look more professional. They work better to create standard invoice documents rather than full tracking systems. While PDFs don’t handle data as well, they look polished when sent to clients.

When templates are better than software

Templates often beat dedicated invoicing software in specific cases:

Startups and small businesses with tight budgets love templates because they’re cost-effective. Unlike software that needs monthly payments, free invoice tracker templates give you core features without ongoing costs.

Templates let you customize everything. You can change spreadsheets to fit your business by adjusting columns, layouts, and formulas as needed. Your system grows with your business without forced workflows.

The simplicity of templates makes them easy to use. Small business owners usually know basic spreadsheet skills already. You won’t need time to learn new software. Your business can start tracking invoices right away without disrupting current operations.

In spite of that, templates have their limits. They lack advanced security features to protect financial data, especially when sharing invoices online. You’ll need to check paid and pending invoices manually. This might slow things down as volume grows.

Templates hit the sweet spot between features and simplicity for businesses with few monthly invoices. You might need dedicated software later when transactions increase or security becomes crucial.

Top 7 free invoice tracker templates for 2025

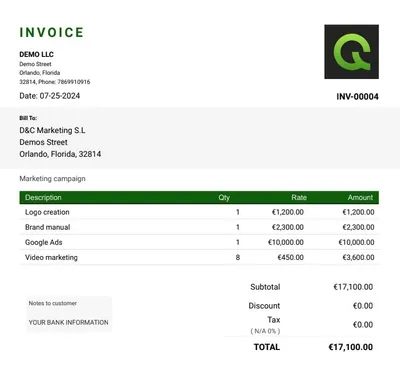

Image Source: Etsy

The right invoice tracker can reshape the scene of your financial management process. Here are the top seven free options for 2025:

1. Order.co Invoice Tracker Template

Order.co’s free invoice tracker template shines with its simplicity and functionality. This Excel-based tracker shows your financial data in multiple ways through an invoice overview tab where you enter individual invoice details. The template has two specialized pivot charts: monthly invoice totals and spend totals by category. These charts update automatically when you refresh the data and give you immediate visual insights into spending patterns. You need to enter invoice date, total amount, remaining amount, and category for accurate calculations. This makes it perfect for businesses that need simple but effective tracking capabilities.

2. Zoho Invoice Template

Zoho’s invoice tracker excels with exceptional customization options. You can match invoices to your brand by adding logos, signatures, custom font colors, and bank details. The multi-language support lets businesses send invoices in their customers’ preferred languages. This builds stronger customer relationships through clearer communication. The template handles tax calculations and compliance requirements automatically. Zoho lets you assign different invoice templates to specific clients based on their needs. This works great for businesses serving customers of all types.

3. Invoice Ninja Tracker

Invoice Ninja’s forever-free plan supports up to five clients with unlimited invoices. The tracker has four professional templates, custom branding options, and online payment capabilities. The best features are automated payment reminders and recurring invoice functionality. Freelancers or startups with fewer than 20 clients will find great value in its accessible interface and simplified processes. Digital invoice creation lets you send them from any device and accept direct client payments.

4. Wave Invoice Tracker

Wave’s free invoice tracker helps you save time and manage customer information better. The platform connects invoicing directly with accounting features to create a seamless financial management experience. The central dashboard lets you track payments and communications, view customer history, and prioritize actions based on payment status. The tracker has professional templates with drag-and-drop customization for brand personalization. Wave’s mobile app for iOS and Android creates invoices anywhere and sends immediate notifications when invoices are viewed, become due, or get paid.

5. Square Invoices

Square’s customizable invoice templates line up with your business identity. Default templates automatically fill in invoice information to save time on repetitive tasks. Square Invoices lets you send unlimited invoices, estimates, and contracts without monthly fees. The system works with various payment methods including credit cards, Google Pay, Apple Pay, and Cash App Pay. Businesses can streamline billing processes with automated payment reminders and real-time tracking through their online dashboard.

6. Refrens Invoice Tracker

Refrens is a 150,000-business strong invoice tracker used in 178+ countries. This detailed platform handles GST-compliant invoices and tracks payments efficiently. ISO/IEC 27001:2022 certification ensures your data stays private and secure. Beyond standard tracking, Refrens offers recurring invoice functionality and multi-currency support. Android and iOS mobile apps create, share, and track invoices on the go. The platform maintains 99% uptime—one of the industry’s best rates.

7. Invoice Temple

Invoice Temple completes our list with its small business-friendly approach. The free plan allows five invoices monthly, perfect for businesses with minimal invoicing needs. The free tier includes premium templates and 24/7 support. You can customize invoices with logos and branding elements without Invoice Temple branding on documents. Try Now Free to see their simple, flat-rate pricing structure with essential features in their starter package.

How to use an invoice tracker template effectively

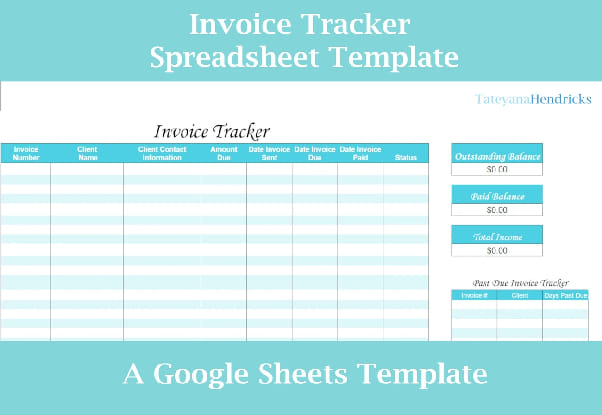

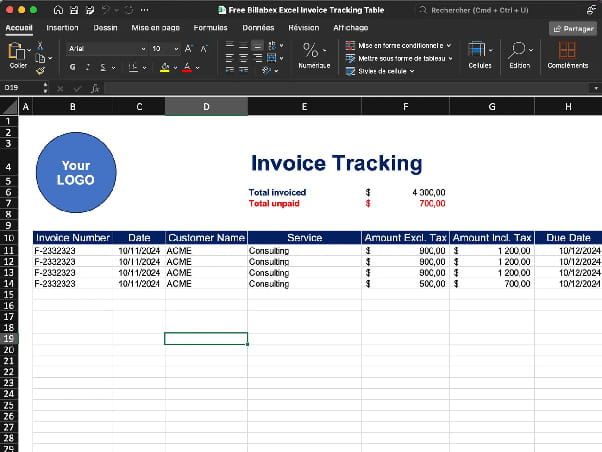

Image Source: Billabex

You need more than just a template to become skilled at tracking invoices—you’ll need a good setup and regular maintenance. A well-organized system from day one will help prevent late payments and make your finances easier to manage throughout the year.

Setting up your invoice tracking spreadsheet

Your functional invoice tracker starts with the right column structure. Open a new spreadsheet and add these important headers:

- Invoice Number: A unique identifier for each invoice

- Date Issued: When you sent the invoice

- Client Name: Who received the invoice

- Status: Typically “Paid,” “Unpaid,” or “Overdue”

- Due Date: When payment is expected

- Invoice Amount: Total amount owed

- Payment Amount: What has been received

- Date Paid: When payment was received

After setting up headers, add your vital formulas. The Excel IF formula calculates overdue days: =IF(ISBLANK(E10),"-",IF(D10="Paid","-",IF((TODAY()-E10)>0,TODAY()-E10,"-"))). This shows how many days an invoice has passed its due date. A simple subtraction formula like =F12-G12 will show the difference between invoice and payment amounts [7].

You can boost visibility by adding filters to each column with the filter icon. This lets you sort invoices by client, status, or date quickly—making invoice tracking much simpler [7].

Tracking due dates and payment status

Good payment tracking means keeping a close eye on due dates and payment statuses. Pick specific times each week to review your accounts receivable. Look for upcoming payments, spot overdue invoices, and plan your follow-ups [8].

Automatic tracking becomes easier with conditional formatting that highlights overdue invoices in red and approaching due dates in yellow. This visual approach helps you focus on collecting payments where they matter most [9].

Aging reports give you a clear picture of outstanding invoices by time periods. These reports group payments that are 30, 60, or 90+ days late, so you can tackle problem accounts first [10]. Most free invoice tracker templates can generate these reports automatically.

Using pivot tables for monthly summaries

Pivot tables turn your raw invoice data into useful insights without complex technical knowledge. Select your entire dataset with headers and click Insert > PivotTable to create one [11].

Creating a monthly revenue summary is straightforward. Drag “Date” to Rows (grouped by month), “Status” to Columns, and “Amount” to Values. Excel calculates totals and shows paid versus outstanding amounts for each period [11].

Your pivot table adapts to different needs. Right-click any value, select “Value Field Settings,” and pick options like Sum, Count, or Percentage. This lets you analyze invoice data in different ways, such as paid invoice percentages by client or average payment times [11].

Make trends easier to spot by creating a pivot chart from your pivot table data. This shows clear visual patterns in monthly invoice totals or outstanding client payments [12].

Sharing with your team or accountant

Team collaboration is key in modern invoice tracking, especially with remote teams. Google Sheets makes sharing simple—just click “Share” and add team members’ email addresses with the right permissions (view, comment, or edit) [13].

OneDrive offers real-time collaboration for Excel users. Everyone works on the latest version of your invoice tracker this way [13].

Your accountant will appreciate exported views that match their specific needs. Most templates let you create filtered views for certain date ranges or transaction types. This focused approach makes financial reviews quick and clear [14].

Keep your data safe by password-protecting your spreadsheet or limiting access to specific sections through sheet protection. These basic security steps maintain data accuracy while supporting team collaboration.

Try Now Free to see how a well-set-up invoice tracker template can change your payment management process.

When to switch from templates to software

Invoice tracker templates work great for small businesses starting out. However, businesses need to upgrade to dedicated software at some point. Early recognition of these signs can save countless hours and prevent errors that get pricey.

Signs your business has outgrown spreadsheets

Frequent errors in your invoice tracking spreadsheet tell you it’s time to switch. Research shows one in ten invoices has some type of error. Businesses miss half of these mistakes before processing payments [15].

The time spent on manual updates gives you another clear signal. Your spreadsheets shouldn’t feel like a full-time job that eats into lunch breaks - that’s a red flag [16]. Teams lose productivity when they spend 60% to 80% of their time searching for data.

The third warning sign shows up in collaboration problems. Your team has outgrown simple templates when they keep asking “Who has the latest version?” or name files like “Inventory_FINAL_v6_ReallyFinal.xlsx” [17].

Benefits of online invoice trackers

Online invoice software creates invoices automatically after a single data entry. The system remembers this information and speeds up future invoice creation [18]. Modern solutions send invoices through email and track payment status.

Integration capabilities are a vital advantage. Quality invoice software combines smoothly with accounting and CRM systems. This ensures data flows without duplicate manual entries [19].

More importantly, advanced solutions provide analytics and reporting features you won’t find in invoice tracker templates. These tools help you monitor outstanding payments, track on-time payments, and create financial reports with ease [19].

Top free software alternatives to templates

Zoho Invoice leads the pack with its forever-free plan that offers excellent customization options and multi-language support [1]. Users can create professional invoices while automating payment reminders.

Wave provides a resilient alternative that connects invoicing directly with accounting features for natural financial management [6]. Its mobile app lets you create invoices anywhere with up-to-the-minute notifications.

Square Invoices lets you send unlimited invoices without monthly fees. You can accept various payment methods including credit cards, Google Pay, and Apple Pay [1].

Invoice Ninja rounds out our list with its forever-free plan. The plan supports up to five clients with no limits on sent invoices [1]. Try Now Free to see how these specialized tools can revolutionize your invoicing process beyond template capabilities.

Choosing the right tool for your business

You need a full picture of your business needs to pick the right invoice tracker. The best tool should line up with your workflow, team size, and financial processes to improve payment times.

Freelancers vs. small teams

Freelancers do well with simplified processes like Harvest. This tool provides time tracking and professional invoicing at USD 12.00 monthly per user [20]. Solo practitioners need simple and affordable tools. Toggl Track or My Hours work great as starting points [21].

Small teams need more shared features. Freshbooks works well for businesses that need complete accounting and invoicing capabilities [22]. Invoicera helps growing teams with resilient infrastructure for staff management. Teams can subcontract work, allocate projects, and assign tasks to members [22].

Time tracking needs

Businesses that bill by the hour must have accurate time tracking integration. Companies might undercharge clients without proper tracking—a common issue with manual methods [21]. The best tools convert tracked hours into invoice items automatically.

Zoho Invoice lets users “run the timer as you work” on mobile and desktop platforms. This captures every minute you can bill [23]. Harvest turns tracked time into reports or invoices with two clicks [20].

Recurring billing and automation

Automated recurring billing offers more than just convenience. Case studies show that businesses using automated billing can recover 1%-5% of recurring revenue through automated dunning features [3]. One company saved 40 work hours and USD 2,000 in monthly revenue through automation [3].

Many tools offer “set it and forget it” features. These generate invoices, send reminders, and update payment status automatically [3].

Integration with payment gateways

Payment gateway integration helps you collect payments faster and improves cash flow. Zoho Invoice connects with major gateways like Stripe, PayPal, Square, Authorize.net, and others [2].

Transaction fees vary by a lot: Stripe charges 2.9% plus 30¢ per transaction, while PayPal costs 2.5% plus a fixed fee [2]. These integrations add payment links to invoices. Clients can pay late invoices right away [24].

International businesses should look for multi-currency support and compliance with regional tax rules. This makes cross-border transactions easier [25].

Conclusion

Small businesses can access powerful financial management tools through free invoice tracker templates without paying premium prices. These trackers started with simple features but have evolved by a lot. They now compete with many paid solutions by offering automated reminders and customizable reporting. A structured invoice tracking system can help small business owners deal with late payments that negatively affect 73% of businesses.

The right template choice depends on your business needs. Simple and affordable solutions work best for freelancers. Small teams need shared features and time tracking capabilities. Most businesses begin with simple Excel or Google Sheets templates and move to advanced options as they grow.

Any invoice tracking system needs regular upkeep. Weekly reviews of payment status, due dates, and collection priorities prevent cash flow issues. Pivot tables help turn raw invoice data into analytical insights without needing advanced technical skills.

Your business will show signs when it has outgrown spreadsheet tracking. These signs include frequent errors, too much time spent on manual updates, and problems with collaboration. Specialized software with automation becomes essential at this stage.

Invoice management keeps changing as remote work and digital payments expand. Quick adaptation to these changes gives small businesses major advantages through better cash flow management, less administrative work, and stronger client relationships. Whatever solution you pick, a structured invoice tracking system is vital for financial stability and business growth.

Try Now Free to see how proper invoice management can revolutionize your business operations today.

FAQs

Q1. What are the benefits of using a free invoice tracker template? Free invoice tracker templates offer small businesses powerful financial management tools without the cost of premium software. They help organize billing processes, maintain cash flow, and provide features like automated reminders and customizable reporting. These templates can significantly reduce the negative impact of late payments, which affects 73% of small businesses.

Q2. How do I choose the right invoice tracker for my business? Selecting the right invoice tracker depends on your specific business needs. Consider factors such as your team size, time tracking requirements, need for recurring billing, and integration with payment gateways. Freelancers may prefer simple, cost-effective solutions, while small teams might need more collaborative features. Start with basic templates and upgrade as your needs grow.

Q3. When should I switch from a template to dedicated invoicing software? It’s time to consider dedicated software when you notice frequent errors in your spreadsheets, spend excessive time on manual updates, or face collaboration difficulties. Other signs include needing more advanced features like automated billing, detailed analytics, or seamless integration with other business systems.

Q4. What are some top free invoice tracker options available? Some popular free invoice tracker options include Zoho Invoice, which offers excellent customization and multi-language support; Wave, which connects invoicing directly with accounting features; Square Invoices, allowing unlimited invoice sending without monthly fees; and Invoice Ninja, supporting up to five clients with no limitations on invoices sent.

Q5. How can I effectively use an invoice tracker template? To use an invoice tracker template effectively, start by setting up essential columns like invoice number, date, client name, and payment status. Use formulas to calculate overdue days and outstanding balances. Regularly review due dates and payment statuses, and consider using pivot tables for monthly summaries. For collaboration, use cloud-based solutions to share with your team or accountant securely.

References

[1] - https://zapier.com/blog/best-free-invoice-software/

[2] - https://www.zoho.com/us/invoice/help/online-payments/

[3] - https://staxbill.com/how-to-automated-recurring-billing/

[4] - https://www.invoiceonline.com/business-newsletter/entrepreneurship/adapting-invoicing-software-for-remote-entrepreneurship-in-2025

[5] - https://stripe.com/us/resources/more/invoice-software-for-small-businesses-a-guide-to-get-started

[6] - https://www.waveapps.com/invoicing

[7] - https://fitsmallbusiness.com/how-to-keep-track-of-invoices-and-payments/

[8] - https://www.brex.com/spend-trends/accounting/how-to-keep-track-of-invoices-and-payments

[9] - https://www.hubifi.com/blog/tracking-invoices-guide

[10] - https://www.bill.com/blog/how-to-keep-track-of-invoices

[11] - https://support.microsoft.com/en-us/office/create-a-pivottable-to-analyze-worksheet-data-a9a84538-bfe9-40a9-a8e9-f99134456576

[12] - https://www.thebricks.com/resources/how-to-create-an-invoice-tracker-in-excel

[13] - https://www.thebricks.com/resources/how-to-create-an-invoice-tracker-in-spreadsheets

[14] - https://help.tradifyhq.com/hc/en-us/articles/21831225509913-Using-Spreadsheet-Pivot-tables-to-create-a-Invoice-summary

[15] - https://enty.io/blog/invoicing-software-vs-invoicing-templates

[16] - https://www.doola.com/blog/7-signs-youve-outgrown-your-spreadsheets-and-need-a-real-business-analytics-tool/

[17] - https://www.prialto.com/blog/5-signs-your-business-has-outgrown-spreadsheets-and-should-use-crm-best-practices

[18] - https://bestreviews.net/moving-from-invoice-templates-to-online-invoices/

[19] - https://www.invoiceonline.com/business-newsletter/finance-and-accounting/why-customizable-invoice-software-beats-templates-in-word-and-excel

[20] - https://www.getharvest.com/

[21] - https://www.hirebasis.com/blog/time-tracking-tools-for-freelancers-and-remote-teams

[22] - https://www.evercast.us/blog/top-invoicing-tools-for-freelancers

[23] - https://www.zoho.com/us/invoice/time-tracking/

[24] - https://lawbillity.com/invoice-tracker/

[25] - https://recurly.com/product/recurring-billing/