Differences Between Electronic Invoices and Digital Invoices

An electronic invoice requires tax validation, while a digital invoice is a simple file like a PDF. Know the differences to ensure compliance.

by QUICKADMIN • 2/9/2024

Differences Between Electronic Invoice and Digital Invoice: A Global Guide

In today’s business world, understanding the differences between electronic invoices and digital invoices is essential for ensuring compliance and efficiency in financial document management. Although these terms are often used interchangeably, they represent distinct concepts that serve different purposes in the invoicing process.

Electronic Invoice

An electronic invoice refers to a type of document that is created, sent, and stored in digital format. It is designed to meet specific requirements set by tax authorities and may be subject to particular regulations depending on the jurisdiction. This type of invoice is usually in XML format or another structured format that allows for automatic validation and processing by management systems and tax platforms.

A key feature of the electronic invoice is that, in many cases, it must be validated and registered in an intermediary system, such as a tax authority portal, before it can be sent to the client. This process ensures that the invoice complies with all relevant legal and fiscal requirements, facilitating auditing and regulatory compliance.

Digital Invoice

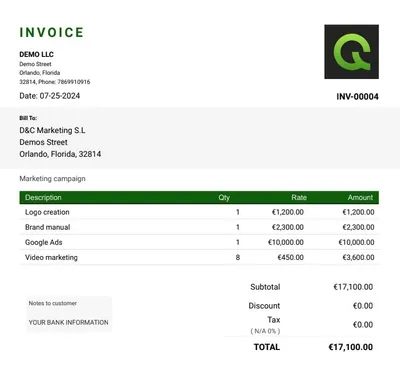

On the other hand, a digital invoice refers to any invoice created and sent in a digital format but not necessarily tied to a validation or tax registration system. Instead of a structured format like XML, digital invoices can simply be PDF files or other formats sent via email or other electronic means.

While digital invoices offer the advantage of greater efficiency in document handling and reduced paper use, their acceptance and validity can vary depending on local regulations. Some jurisdictions allow the use of digital invoices without additional validation, while others require these documents to be managed through specific systems to ensure compliance.

Key Considerations

Regulatory Compliance: Electronic invoices are often subject to specific validation and registration requirements that can vary by region. It’s important to understand local regulations to ensure electronic invoices are accepted by tax authorities.

Format and Storage: Electronic invoices usually require a structured format and must be stored securely to meet legal requirements. In contrast, digital invoices can be stored in various formats, but their acceptance may depend on applicable regulations.

Sending Process: Electronic invoices generally go through a validation system before reaching the recipient, while digital invoices can be sent directly via email or digital platforms without additional validation.

In summary, although both types of invoices are digital, their differences in terms of format, validation, and regulatory compliance can have significant implications for businesses. Understanding these differences and how they apply in your jurisdiction is crucial for managing invoicing effectively and ensuring compliance with relevant regulations.