Creating Invoices: Essential Fields to Include

Include key fields in your invoices to ensure clarity and compliance. These details will help you create professional invoices for your clients.

by Quickadmin • 5/9/2024

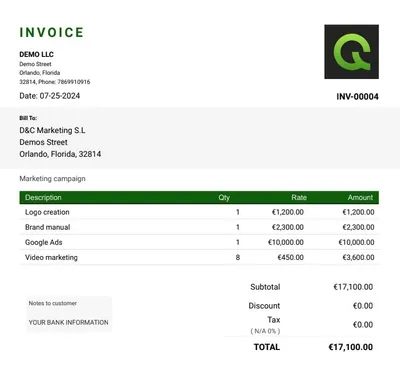

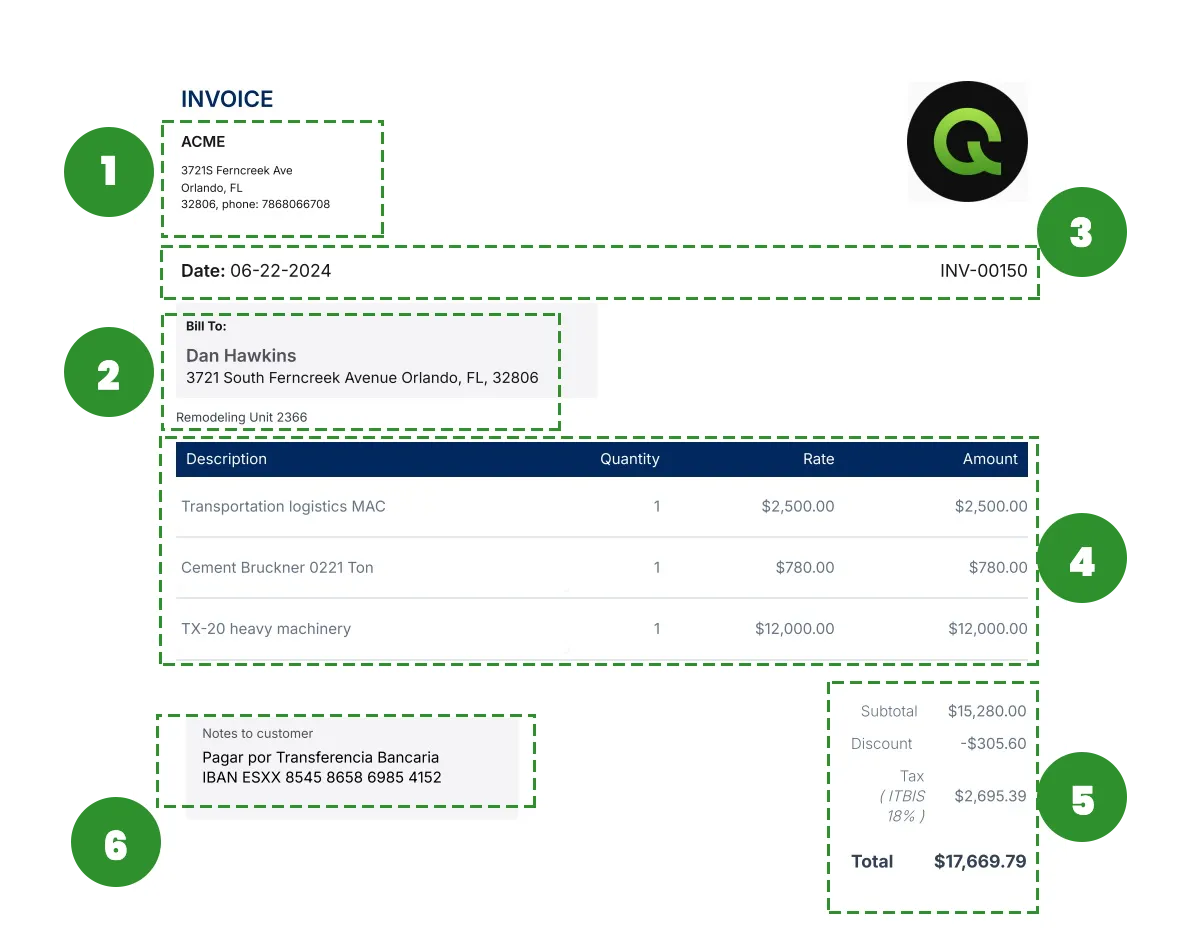

When generating an invoice, there are key fields that you should consider to ensure clarity and compliance. Including the following details will help you create professional invoices to send to your clients:

Issuer’s Name and Address: Provide your company’s legal name, physical address, and email address.

- Legal Name of Your Company: The legal name of your company is the official, registered name under which your business operates. Including this on invoices helps identify your business entity for legal and financial purposes.

- Physical Address: Specific location where your company can be found. It typically includes several key components to ensure accurate identification and delivery.

- Contact Email: Your company’s contact email.

Customer’s Name and Address: Include the customer’s name and physical address accurately to facilitate smooth delivery and communication.

Customer’s Name: This refers to the individual or entity to whom you are providing goods or services. Including the customer’s name ensures clarity in identifying the recipient of the invoice.

Customer’s Address: The customer’s address is essential for accurate delivery and communication. It also helps maintain a record of where the products or services were provided.

Invoice Details:

Invoice Number: An invoice number is a unique identifier assigned to each invoice you generate. It aids in tracking and referencing specific transactions in your records.

Date of Issue: The date of issue is the date when the invoice is created. It establishes a clear timeline for payment and record-keeping purposes.

Description of Products or Services: Clearly outline the products or services being billed, including quantity, description, and unit price.

Itemized List of Products/Services: Providing a detailed breakdown of the products or services rendered helps the customer understand exactly what they are being charged for.

Quantity: The quantity field specifies how many units of a product or hours of a service were provided.

Unit Price: This is the price per unit of the product or service, helping calculate the total cost for each line item.

Financial Information:

Subtotal: The subtotal is the sum of all the costs before any taxes, discounts, or adjustments are applied.

Taxes: Including applicable taxes ensures compliance with tax regulations and provides transparency regarding the total amount owed.

Discounts/Adjustments: Any discounts or adjustments made to the total amount should be clearly outlined to avoid confusion.

Total Amount Due: This field represents the final amount the customer is required to pay, considering all costs and adjustments.

Payment Information:

Accepted Payment Methods: Communicating accepted payment methods helps streamline the payment process for your customers.

Payment Terms: Payment terms define the deadline by which payment is due (e.g., Net 30 indicates payment is due within 30 days).

Additional Notes:

Terms and Conditions: Including terms and conditions on the invoice sets out the agreements and expectations for the transaction.

Return Policy: Providing information on your return policy can help manage customer expectations and reduce disputes.

It’s important to note that these recommendations serve as a general guide and may vary based on specific state or federal tax regulations. Consulting with a tax expert or accountant can provide further insight into ensuring compliance with tax obligations.

By incorporating these essential fields in your invoices, you can streamline the billing process and maintain professionalism in your transactions with your clients.