How Estimate Software Improves Small Business Finances

Learn how to optimize your finances and achieve your business goals with this powerful technological solution.

by Eng. Jose Manuel Siso Colmenares • 1/26/2025

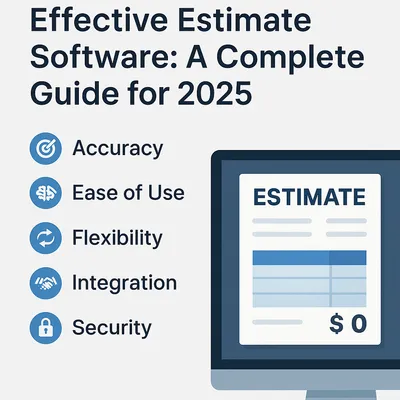

Benefits of estimate software in financial planning for small businesses

In today’s fast-paced and competitive business environment, small businesses need every advantage they can get to stay ahead. Generally, entrepreneurs focus on strategies to increase sales through marketing tools or creative ideas to find more clients. However, financial planning is often a forgotten area that needs special attention to create a positive impact on a business organization.

As mentioned in previous posts, estimate software has become an invaluable tool for small businesses, offering a range of benefits that streamline operations, improve financial accuracy, and enhance client relationships.

The technology of this software offers a variety of benefits to increase the efficiency of different types of businesses, from larger companies to small starting ones. To go deeper into the subject, in this article, we will be exploring the key advantages of using estimate software in financial planning.

With this information, you will be able to better understand the importance of this tool in enhancing the reach of your small business. Keep reading to know more about this interesting topic.

1.- Resource savings

In a previous article, we mentioned 5 ways estimate software saves time for busy plumbers. As you may have noticed, these aspects do not apply only to this business area.

Resource savings is one of the most significant advantages estimate software has to provide, as it significantly reduces the time and manpower used in financial planning tasks such as manual calculations, spreadsheets, and repeated data entry.

By automating calculations and generating accurate estimates, the software allows small businesses to allocate their resources more efficiently and assign their employees critical tasks from other priority areas.

2.- Ensure compliance with legal requirements

In addition to improving efficiency through resource savings, small businesses also have to consider financial stability to comply with legal requirements. Errors in financial planning or reporting are critical aspects that can lead to penalties and damage to a company’s reputation.

Fortunately, estimate software is designed to integrate up-to-date tax rates, accounting standards, and legal requirements into its system, allowing businesses complete control over their transactions and stay compliant with specific regulations.

The technology of these programs offers customizable solutions that align with different specific industries. Therefore, they ensure that all financial documents, from invoices to estimates, adhere to the necessary standards.

With these characteristics, from its built-in systems for tracking changes and updates to financial regulations, business owners can be unconcerned about possible risks of oversight or non-compliance.

3.- Better cash flow management

Another benefit of estimate software in financial planning is its effective cash flow management, as it offers small businesses an opportunity to grow over time. The software includes different tools that enable the tracking of outcomes and expenses, predict future cash flow, and make informed financial decisions with this data.

With real-time data and forecasting features, businesses can gain a clear understanding of their financial health. This allows them to anticipate potential cash flow issues and address them proactively.

Moreover, integrating estimate software with other financial tools, such as invoicing or accounting systems, provides a comprehensive overview of the company’s finances.

4.- Reduce financial errors

Manual calculations and data entry are prone to human error, leading to costly financial mistakes. Estimate software significantly reduces the likelihood of errors by automating complex calculations and ensuring that data is entered correctly.

Part of the estimate software solutions include error-checking features that identify inconsistencies or discrepancies in financial data. The level of accuracy the technology offers not only prevents financial losses but also enhances the credibility of the business in the eyes of clients and stakeholders.

In addition, this advanced tool eliminates the need for time-consuming audits and corrections, further streamlining financial planning processes.

5.- Better Client Communication

Strong client communication is vital for building trust, especially when finances are involved. Therefore, another aspect in which estimate software helps the financial planning for small businesses is facilitating and enhancing this communication by providing professional, transparent, and accurate documentation.

The creation of estimates and invoices with one technological tool not only optimizes the resources of a business but also offers their clients a polished and professional reflection of their activities through detailed reports.

Moreover, the software also enables businesses to share estimates with clients electronically, making it easier for clients to review and approve them. This, in turn, strengthens client relationships, fosters long-term loyalty, and improves competitiveness in the market.

As you can see, this powerful tool offers a wide range of benefits for small businesses engaged in financial planning. Their advantages are numerous and impactful, enhancing efficiency, boosting competitiveness, and empowering companies to achieve their financial goals.

If you are interested in starting to create estimates and invoices with accessible software, at QuickAdmin you will find the ideal technology for you. Try out our free plan, which allows you to generate 3 monthly invoices, 6 estimates, two jobs, and unlimited clients; you will notice the difference in your financial organization from the beginning.